The Best Guide To Loss Adjuster

Wiki Article

Getting The Property Damage To Work

Table of ContentsSee This Report on Property DamageThe Best Strategy To Use For Public AdjusterGet This Report on Public Adjuster

A public adjuster is an independent insurance coverage specialist that an insurance policy holder might hire to aid resolve an insurance coverage claim on his/her part. Your insurance provider gives an adjuster at no fee to you, while a public adjuster has no connection with your insurance provider, and bills a cost of up to 15 percent of the insurance coverage negotiation for his/her services.

If you're considering employing a public insurer: of any type of public insurance adjuster. Ask for recommendations from household as well as associates - loss adjuster. Ensure the insurer is accredited in the state where your loss has actually taken place, and call the Bbb and/or your state insurance department to look into his/her document.

Your state's insurance coverage division might establish the portion that public insurance adjusters are allowed charge. Watch out for public insurers that go from door-to-door after a disaster. loss adjuster.

Cost savings Contrast rates as well as conserve on residence insurance coverage today! When you submit an insurance claim, your property owners insurance coverage company will certainly assign a cases insurance adjuster to you.

Facts About Property Damage Uncovered

Like an insurance claims adjuster, a public insurance adjuster will evaluate the damages to your building, aid determine the range of repair services and also approximate the substitute value for those repair work. The huge distinction is that instead of functioning on behalf of the insurance policy business like an insurance asserts adjuster does, a public cases insurance adjuster helps you.

The NAPIA Directory site lists every public adjusting firm needed to be certified in their state of operation (property damage). You can enter your city and also state or ZIP code to see a listing of adjusters in your location. The various other way to find a public insurance adjuster is to get a referral from pals or member of the family.

Reading on-line consumer reviews can also be useful. When you discover a couple additional info of contenders, discover out just how much they bill. Many public adjusters maintain a percentage of the final claim payout. Maybe just 5 percent and also as much as 20 percent. If you are facing a big insurance claim with a potentially high payment, consider the cost before choosing to hire a public insurance adjuster.

Things about Loss Adjuster

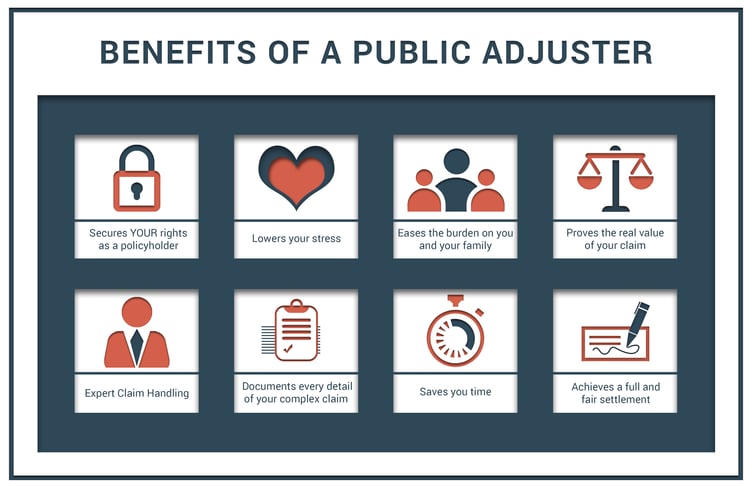

To attest to this dedication, public insurance adjusters are not compensated front. Instead, they obtain a percent of Find Out More the settlement that they obtain in your place, as managed by your state's department of insurance. A knowledgeable public insurance adjuster functions to accomplish several jobs: Understand as well as assess your insurance coverage Support your civil liberties throughout your insurance claim Precisely as well as thoroughly analyze and also value the extent of the building damages Use all policy stipulations Discuss a maximized negotiation in an efficient as well as efficient way Collaborating with a seasoned public insurer is just one of the very best means to get a rapid and also fair negotiation on your claim.

Therefore, your insurance provider's representatives are not necessarily going to browse to uncover every one of your losses, seeing as it isn't their obligation or in their finest rate of interest. Considered that your insurance provider has an expert working to secure its passions, shouldn't you do the exact same? A public insurer can deal with several sorts of claims more info here in your place: We're often asked concerning when it makes feeling to hire a public cases insurer.

Nonetheless, the bigger and much more complex the insurance claim, the more probable it is that you'll require professional assistance. Hiring a public adjuster can be the ideal selection for numerous different sorts of building insurance cases, particularly when the stakes are high. Public adjusters can help with a number of useful jobs when browsing your insurance claim: Translating plan language as well as determining what is covered by your provider Conducting a complete evaluation of your insurance coverage Considering any recent adjustments in building codes and also legislations that might supersede the language of your policy Finishing a forensic analysis of the residential or commercial property damage, commonly discovering damages that can be or else hard to discover Crafting a tailored prepare for getting the ideal negotiation from your residential or commercial property insurance policy claim Documenting and also valuing the full extent of your loss Assembling photo proof to sustain your case Handling the day-to-day jobs that usually come with suing, such as connecting with the insurance policy company, going to onsite conferences as well as submitting records Presenting your cases package, including supporting documentation, to the insurer Masterfully negotiating with your insurer to ensure the biggest settlement feasible The best component is, a public insurance claims insurer can get entailed at any point in the insurance claim declaring procedure, from the moment a loss takes place to after an insurance coverage claim has actually already been paid or denied.

Report this wiki page